Introduction

All data in this article comes from the research report "The Development of Casino Gambling in Vietnam and Its Impact on Macau" by Professors JI Chunli and HUANG Guihai from the Macau Polytechnic Institute and Research Center.

PASA attempts to interpret the content of this report to bring unnoticed strategic opportunities to industry players and provide some suggestions and valuable insights.

First, we briefly organize the development history and current situation of the casino gambling industry in Vietnam, and analyze the prospects of this industry in Vietnam based on the key points of the new gambling laws.

On this basis, we explore the competitive relationship between the casino gambling industry in Vietnam and Macau, and the potential impacts on each other.

According to the data from the research report by the two professors mentioned above, although the development of the gambling industry in Vietnam has limited competition impact on Macau's gambling industry in the short to medium term, the long-term impact could be significant.

Macau's gambling industry is likely to be affected by the cumulative effect of the development of the gambling industries in Vietnam and surrounding countries (regions).

Indeed, this coincides with PASA's view, as previously discussed in the articles "Industry Depth: The End of an Era, Offline Casinos to be 'Replaced'" and "From Prosperity to Decline: Macau Casino Stock Price Plummets 90% Just a Reflection of the Industry, Where is the Transformation Path for Offline Casinos?", which have already elaborated on the developmental setbacks and various competitive challenges currently faced by Macau's offline gambling.

This article will focus on the long-term strategic planning of the gambling industries in Macau and Vietnam, using the research of the two professors as an anchor point, to discuss the key factors for breaking through in these two markets.

Current Status of the Gambling Industries in Vietnam and Macau

In recent years, the gambling industry in the Asia-Pacific region has developed rapidly, with several Southeast Asian countries opening up gambling regulations, and the industry showing a competitive development trend.

Although Macau still leads the world in gambling revenue compared to other cities, the development of the casino gambling industry in Vietnam is noteworthy.

Although the current scale of Vietnam's gambling industry cannot yet compare with Macau, Vietnam is actively planning its casino gambling industry.

Vietnam declared the northern city of Haiphong as an economic development zone in 1989, allowing foreigners to operate casinos within the development zone.

Subsequently, Vietnam officially issued the first casino gambling license in 1992 (Dang The Duc, Vo HuuTu, Marc Desert, 2012).

The first to receive this gambling license was the Do Son Casino in Haiphong, which opened in 1994 (Zhu, 2016).

Since then, several casinos have gradually opened and operated in different provinces of Vietnam.

Based on the information available, there are currently 13 casino projects in Vietnam, including those under operation, construction, and planned (excluding hotels with only electronic gambling machines), with 8 in operation, distributed in the northern, central, and southern parts of Vietnam.

Among the operational casinos, the Grand Casino at The Grand Ho Tram Strip Resort in the Vung Tau area in southern Vietnam is the largest, with 90 gambling tables and 630 electronic gambling machines.

In terms of gambling revenue, since the Vietnamese government does not disclose information about casinos, it is impossible to obtain exact data on Vietnam's gambling revenue. However, it is possible to roughly understand the revenue scale of Vietnamese casinos from some estimated data.

For example, an author named Muhammad Cohen wrote an article in Forbes Asia in 2016, estimating that Vietnam's 8 licensed casinos and 20 gambling machine clubs (all small in scale) generate about $300 million in gambling revenue annually.

According to PASA's estimate of the average growth rate of 25% for emerging market countries, Vietnam's gambling revenue could grow to approximately $2.4 billion by 2024.

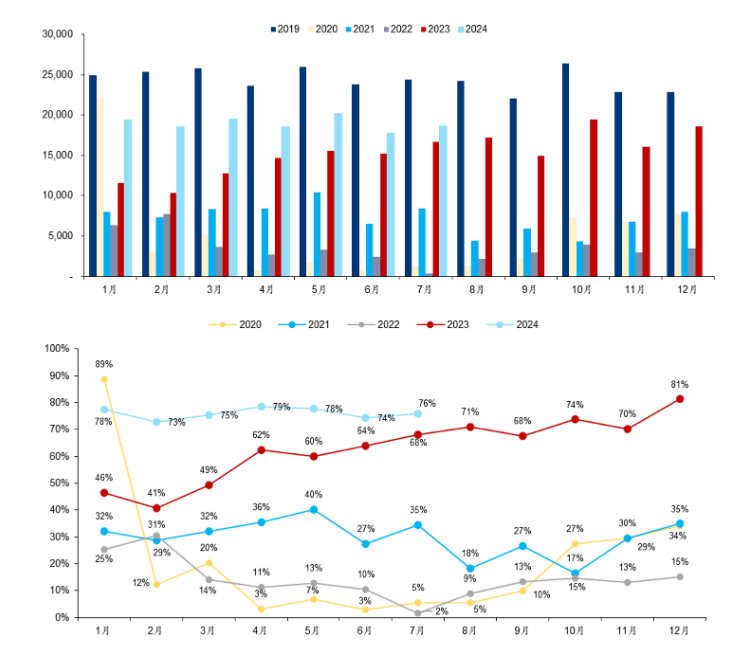

Meanwhile, Macau's gambling revenue in 2024 is expected to still maintain over $20 billion, but the revenue shows an irregular decline.

The following image shows that since 2019, Macau's gambling revenue has never recovered to its peak, continuing to languish at the bottom.

While the scale of Vietnam's gambling industry is still small, its development is rapid.

The development of the casino gambling industry in Vietnam is closely linked to the country's "Doi Moi" reform and opening-up policy, which began in 1986.

In 1987, the Vietnamese National Assembly passed the relatively liberal "Foreign Investment Law," laying the legal foundation for foreign investment in casinos in Vietnam.

In 1989, Haiphong was designated as an economic development zone, allowing the casino gambling industry to officially take root in Vietnam. Since then, Vietnam's casino gambling industry has continued to develop, but according to Vietnamese law, all casinos are only open to foreigners and Vietnamese nationals holding foreign passports and residing abroad, with Vietnamese citizens prohibited from entering local casinos for gambling.

After many years of preparation, the Vietnamese government finally issued a new casino decree on January 16, 2017 (Casino Decree, No. 03/2017/ND-CP, hereinafter referred to as "the new decree").

Overall, the key points of this decree include the following, which PASA calls the "Golden Four":

1. Conditions and licenses for operating casinos: According to the new decree, business operations involving gambling activities are conditional commercial activities, which can only be auxiliary businesses to the main business (e.g., tourism, hotels, resorts, or integrated entertainment activities).

2. Number of electronic gambling machines and gambling tables: The quota for electronic gambling machines and gambling tables is determined by the Prime Minister based on the total investment amount of the enterprise. For every $10 million invested, a gambling company can obtain a quota of 10 electronic gambling machines and 1 gambling table.

3. Grandfathering: For gambling companies that had obtained investment registration certificates before the official implementation date of the new decree and had already started gambling operations, there is no requirement to obtain a satisfaction certificate, and they can continue to operate based on the existing license.

4. Allowing Vietnamese citizens to enter Vietnamese casinos for gambling: As part of a 3-year pilot program, the new decree allows Vietnamese citizens aged 21 or above with a fixed monthly income of no less than 10 million Vietnamese dong (approximately $438) to enter Vietnamese casinos for gambling.

Due to the revision of the gambling regulatory law, Vietnam was able to achieve relatively rapid growth in land-based gambling from 1994 to 2010.

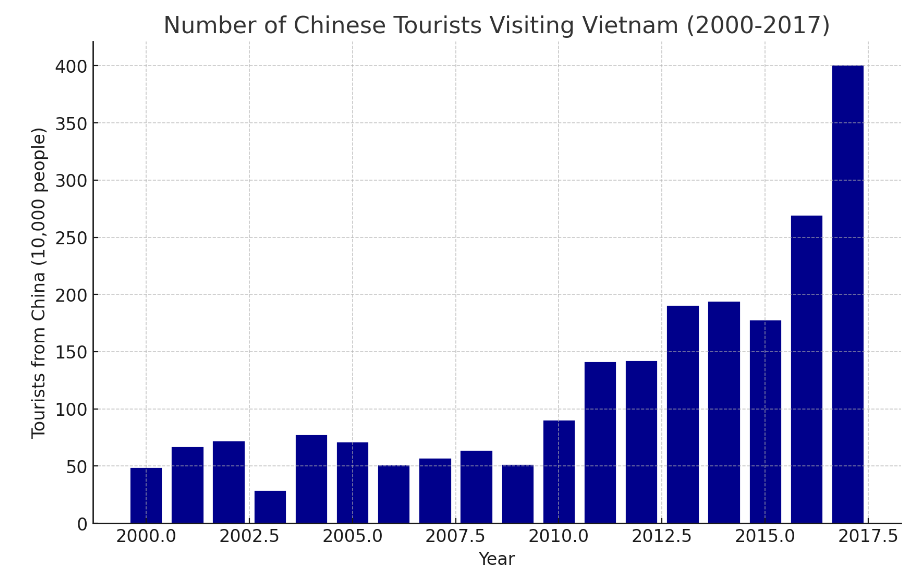

With the momentum of Vietnam's tourism industry, the number of international tourists exceeded 12.9 million in 2017, 5.5 times that of 2001. From a domestic perspective, the number of Vietnamese domestic tourists reached 62 million in 2016, 5.3 times that of 2001.

Both international and domestic tourists represent a considerable potential consumer group for Vietnam's gambling industry.

However, with the arrival of Covid-19, Vietnam's offline casinos face the same dilemma as Macau— a significant reduction in gamblers.

Although there are no official statistics, according to PASA's analysis of changes in the number of tourists in Vietnam, the number of players in Vietnam's offline casino gambling had already reached its peak in 2017.

This coincides with the time when the number of offline gamblers in Macau began to decline, as mentioned in the article "Industry Depth: The End of an Era, Offline Casinos to be 'Replaced'".

It can be seen that, from a macro perspective, Vietnam's offline gambling industry and Macau's offline gambling industry have both fallen into a red ocean competition—the scale of offline casinos has begun to gradually shrink, which is the biggest challenge both regions are facing in the gambling industry.

Facing Challenges, How Can Regional Gambling Achieve a Breakthrough?

As also mentioned in the article "Industry Depth: The End of an Era, Offline Casinos to be 'Replaced'", in fact, a significant part of the market lost by offline casinos has flowed into online casinos.

In the article "From Prosperity to Decline: Macau Casino Stock Price Plummets 90% Just a Reflection of the Industry, Where is the Transformation Path for Offline Casinos?", we also analyzed that Macau, which holds such a large gambling revenue in the world, is not sitting idly by watching the decline in gambling revenue. Among them, Alvin Chau, the crown prince of Macau's gambling industry, is trying to open the path to online gambling through digital sports and esports.

However, given the monopoly and full competition in Macau, as well as the research analysis of the development of Vietnam's gambling industry, PASA believes that the Vietnamese market is more likely to achieve a breakthrough in red ocean competition—achieving rapid development in online casinos.

To a large extent, this is based on the Vietnamese government's emphasis on the gambling economy.

In terms of gambling tax rates, the current tax rate for Vietnamese casinos is 35% of the gross gambling revenue (GGR), but according to official statements from Vietnam, the gambling tax rate in Vietnam is likely to be reduced in the future.

According to available information, Vietnam is discussing implementing tax incentives for gambling enterprises in special economic zones, with a preferential tax rate of 17% for the first five years.

A lower gambling tax rate is conducive to stimulating investment and development in Vietnam's future gambling industry.

As stated in PASA's article "Opportunity! Vietnam's Online Gambling Industry About to Change?", Vietnam is increasing the development of its casino gambling industry. On one hand, it sees the success of the casino gambling industries in surrounding markets such as Macau, Singapore, and the Philippines. On the other hand, due to economic pressures, it is trying to stimulate the development of the gambling industry to boost the economy, create job opportunities, increase tax revenue, and attract local and foreign capital and other resources.

Therefore, even though Vietnam's online casino market is still in a complex state overall, regulations have been somewhat relaxed, and there is a high possibility that it will be fully opened in the not-too-distant future.

In the foreseeable future, the aforementioned "Golden Four" regulations for physical gambling are also expected to be implemented in the online gambling industry.

Although currently prohibited by law, there are already a large number of online casinos in the Vietnamese market.

These platforms often operate abroad, especially registered in regions such as the Philippines and Cambodia, targeting the Vietnamese market. Through social media, many foreign online gambling platforms have attracted a significant number of Vietnamese users.

From the current perspective, as the industry develops, many investors are beginning to try combining entertainment with digital platforms to provide online gaming experiences for casino players, but without involving gambling. For example, the following real-money chess game "Tiến Lên".

This is very similar to the markets in India and Japan, where through the gamification of gambling, various real-money gaming projects have entered the Vietnamese market. (Related articles: "iGaming Operations New Heights: Evaluating India's Real Money Games! How to Enter the Indian Real Money Game Market Creating $5 Billion in Revenue with Unique Details!" "Gambling Chronicles in Japan: From Street Pachinko to Online Gambling, Can Pachinko Real Money Games Divide This $110 Billion Market and Become the New Favorite of Japanese Gamblers?")

According to PASA's research, the demand for related games among Vietnamese users is very strong, with many Vietnamese users even willing to use virtual private networks (VPNs) to access foreign online gaming platforms to evade local laws.

Vietnam's technology development industry is growing rapidly, especially in the blockchain field. Many platforms use blockchain technology to evade Vietnamese government regulation and tracking, and have developed related innovative encrypted games, such as the very popular "AXIE INFINITY" in Vietnam.

The methods mentioned above are all in the gray area of the Vietnamese market and can fully draw on the experiences of India and Japan. (For more related information, follow: https://t.me/pasaqqzxzz)

Conclusion

In summary, PASA believes that Vietnam will be a gambling treasure trove comparable to markets such as India and Japan, although online gambling in Vietnam is not yet legal.

However, overall, the Vietnamese government's regulation is not strict, and many investors are entering the Vietnamese market by developing real-money games and encrypted games.

Moreover, Vietnam is trying to stimulate the gambling industry to drive national economic growth, and in the short term, Vietnam has a great possibility of completely opening up all gambling markets, which is also the reason for the ambiguous attitude of the official online gambling regulation.

In conclusion, not only Vietnam and Macau have fallen into the red ocean competition of the offline gambling industry, but the entire Asia-Pacific market and even the world, the only way out for the casino gambling industry is undoubtedly to lean towards online.

Whoever can become the next phase's online pioneer will be able to lead the new era of the gambling industry.

We look forward to discussing more unique insights about Vietnam's online gambling with our readers and sincerely invite you to follow the global iGaming leader's overseas information platform PASA for more first-hand industry information.

Welcome to subscribe to PASA's official channel: https://t.me/PASAIGHYJL