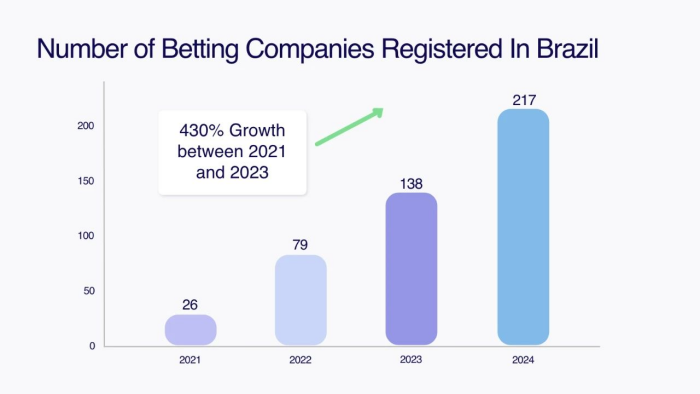

The Brazilian sports betting market is facing astonishing growth. According to recent data from Datahub, the entry of Brazilian online gambling enterprises grew by 734.6% from 2021 to April 2024, with the number of operating registered companies increasing from 26 to 217.

Since December 2018, sports betting has been legally recognized in Brazil. This country, with a population of about 200 million, has developed into one of the top ten gambling markets globally, with total gambling revenue equivalent to the sum of Spain and the Netherlands.

However, it was not until 2023 that Brazil introduced new comprehensive gambling legislation, and starting from October 1, 2024, all underground illegal gambling operators will be comprehensively banned.

In 2021, there were only 26 companies operating online gambling businesses in Brazil. In 2022, the increase reached 203%, with a total of 79 companies joining by the end of the year.

In just the first four months of 2024, the number of newly opened companies has already equaled that of 2022.

This year, under the background of the official full implementation of gambling compliance operation policies in Brazil, global gambling operators have flocked here, and the business opportunities behind this are definitely very huge.

In previous articles, PASA has deconstructed many opportunities in the Brazilian market for industry players, such as real money games, fantasy sports, and more.

This article focuses on the direction of sports betting in Brazil, exploring what other sports betting opportunities are contained in this country known for its samba football.

Current Status of the Brazilian Sports Betting Market

Brazil has a close cultural connection with sports and gaming.

According to a study conducted from 2016 to 2017, it is estimated that Brazilians spend about 2 billion Brazilian reais annually on overseas online casinos and gambling companies, potentially reaching up to 10 billion reais (about 2 billion USD).

According to KPMG data from 2017, the Brazilian gambling market was estimated to be about 2.2 billion USD at that time, with about 60% (1.3 billion USD) coming from sports betting and 40% (900 million USD) from online casinos, including popular games like poker and bingo.

Four years later (2021), according to widely recognized survey data from Globo, despite the impact of the pandemic, sports betting alone had already reached 7 billion Brazilian reais (1.25 billion USD) the previous year.

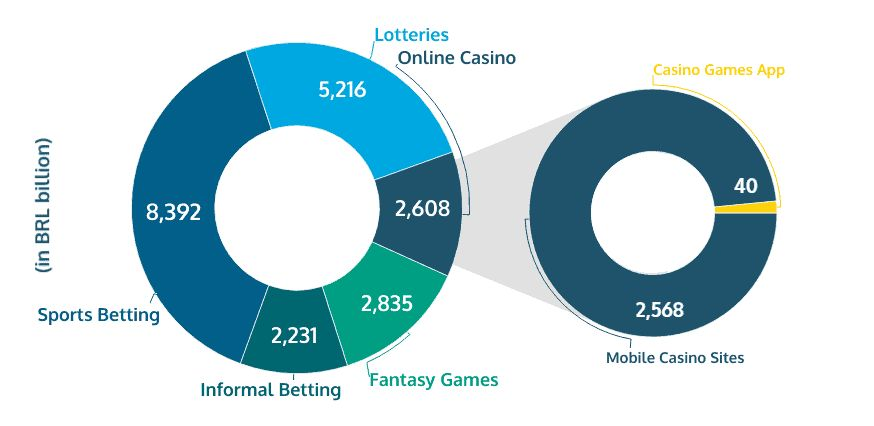

If KPMG's data is also correct, then including online casinos, lotteries, and all other popular real money games, the total market size in Brazil in 2021 should be 3 to 4 times the original - 210 billion to 250 billion Brazilian reais (about 45 billion USD).

The Brazilian Institute of Legal Gambling (IJL) indicates that the actual figures are even higher.

This makes the gambling and iGaming industry increasingly competitive in Brazil.

Recent industry surveys show that up to 2/3 of Brazilian adults participated in online gambling last year. This means that about 106 million people (out of 160 million adults nationwide) have their favorite paid luck or skill-based games.

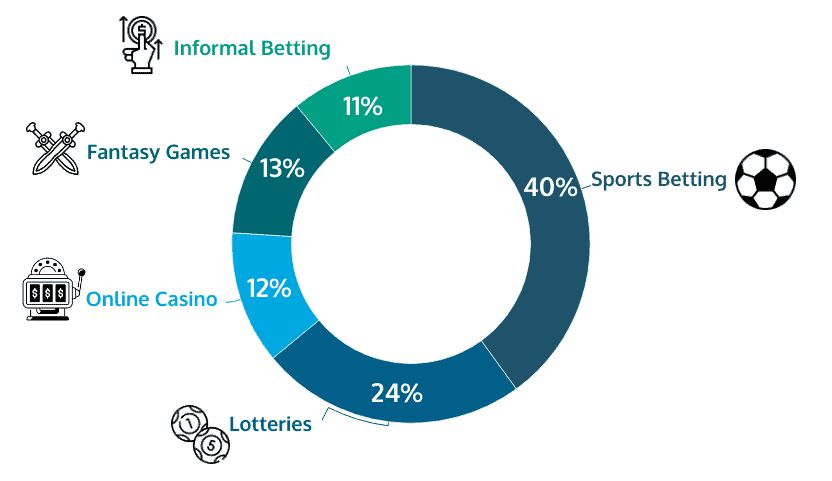

In terms of game preferences, about 74 million people participate in sports betting, and 46 million choose lottery or bingo games, with sports betting accounting for 40% of the entire Brazilian spinach market.

Since the official legalization of sports betting in 2018, the sports betting industry has seen a surge in player interest and turnover.

Sports betting in Brazil easily surpasses all other real money games, partly because Brazilians love football.

But if only based on the data available from Statista, it is not entirely possible to fully appreciate how high the market revenue in Brazil is—many casino operators offer downloadable apps, but with the development of responsive platforms, many players simply log in from their mobile websites.

This form is particularly common when players use online casinos, and if we only look at the online revenue generated by online casino gaming apps, these revenues are just a part of the entire market.

It is estimated that the current market size of mobile app casinos is between 35 million and 40 million USD. Moreover, about half of the app revenue comes from advertising, with the rest from in-app purchases. Overall, even by moderate industry and political estimates, this only accounts for 1.53% of the value of the Brazilian online casino market.

The reason these figures are not high is due to the nature of mobile gaming platforms, where the number of app-based casino games (including classic and new-age) is limited. The only included games are poker (34%), bingo games (16%), and some independent slot apps (10%).

In short, users visit casino websites, play games, and then continue. If they are satisfied, they will come back, but rarely download multiple apps.

Therefore, based on this data, we can start from the user's perspective, the growth of online sports betting in Brazil is mainly driven by the country's young and tech-savvy population.

The population structure shows that only 10.3% of the population is aged 65 and above, while 82.3% are aged between 13 and 64, who are considered a digitally active group interested in gaming and sports.

Moreover, Brazil's internet penetration rate is 81%, with 173 million users and a total of 206 million mobile connections, ranking fifth globally.

In major metropolitan areas such as São Paulo, Porto Alegre, Curitiba, Rio de Janeiro, and Belo Horizonte, 5G connections have been fully deployed. The average internet speed in densely populated areas is higher, which matches the residences of most mobile users—over 87% of Brazil's population lives in urban areas.

A report focused on the mobile industry in Latin America indicates that Brazil's growth in in-app spending (20% increase in 2022). Brazil leads the regional market with 10.6 billion app downloads, ranking fourth globally in overall app adoption, just behind China, India, and the USA.

In such a vibrant tech-driven environment, gambling industry operators wisely recognize that as long as they offer excellent products, they can unleash the great potential of the Brazilian market.

Opportunities in Brazil's Domestic Football Industry

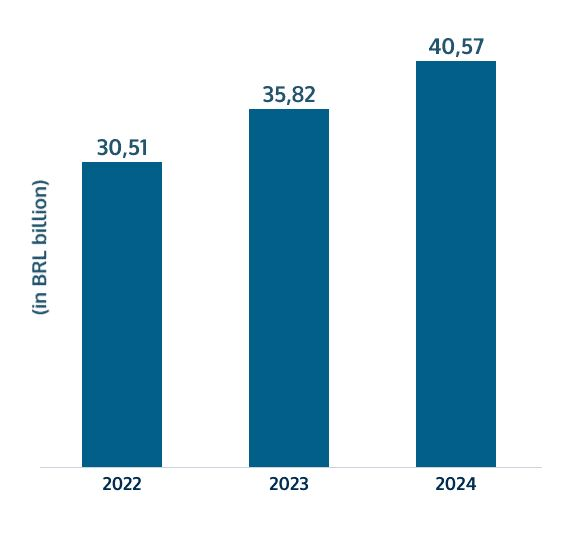

It is expected that by 2028, the online gambling industry size will reach 3.63 billion USD, with a compound annual growth rate of 16.51% from 2024 to 2028.

Due to the relaxation of gambling brand licensing in Brazil, the industry will be more attractive to global operators.

Football, as Brazil's national sport, undoubtedly occupies the most important part of Brazilian sports betting, although there are no precise segmentation data, but we can analyze from the speed of international operators entering the sponsorship of Brazilian domestic football leagues.

Between the end of 2022 and 2024, among the 20 top teams in the Brazilian top league, 6 out of 12 sponsored brands came from the international market, with sponsorship funds showing exponential growth.

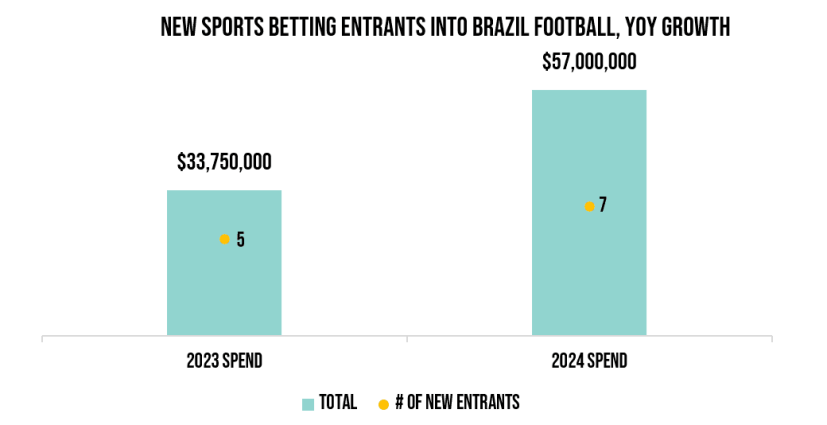

In the past two seasons, a total of 12 new sports betting brands have entered Brazil's two major leagues.

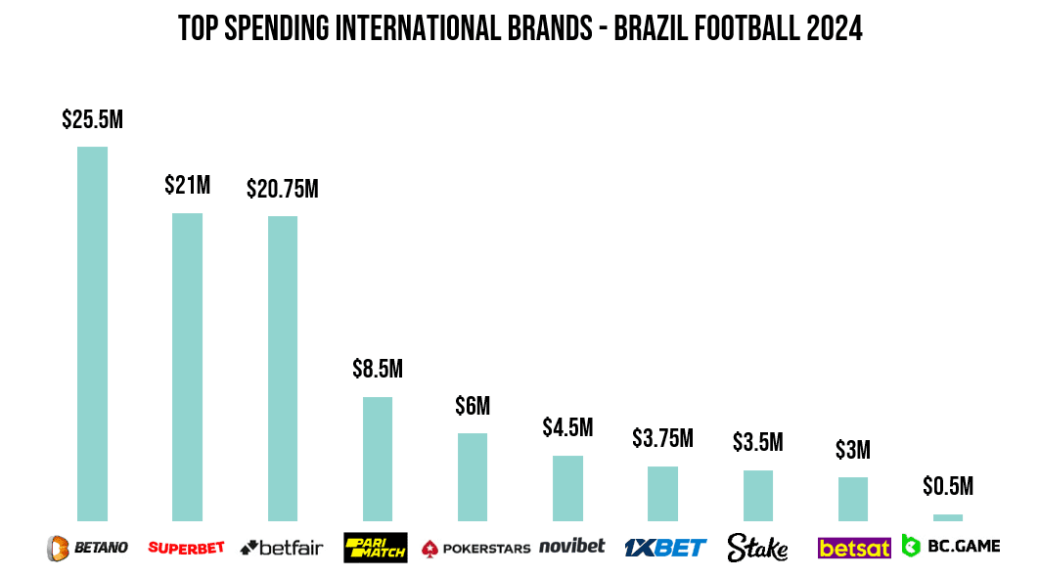

Six newcomers are from international regions (Superbet, Parimatch, Novibet, Stake.com, Betsat, and BC.Game), and as of the 2024 season, they have spent a total of 41 million USD, accounting for 72% of the expenditure of new entrants this season.

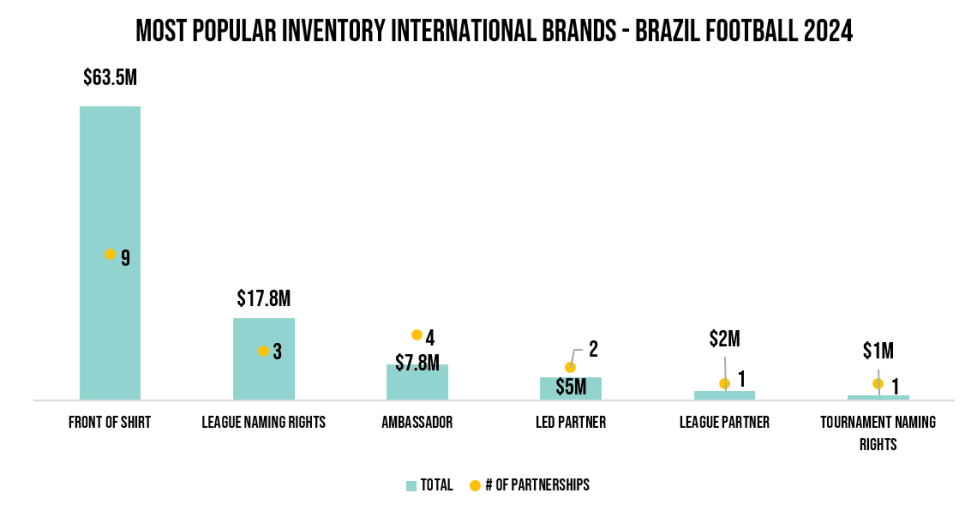

Currently, the total sports betting sponsorship expenditure in Brazilian football is 210 million USD, from over 60 active deals and 27 brands. Out of this total expenditure of 210 million USD, 97 million USD (46%) comes from international brands, which hope to take advantage of the market's openness and its high growth potential.

Moreover, nine out of ten international investors have entered the market since the 2021 season, with the only exception being Pokerstars and its long-term partnership with Neymar.

Currently, international brands spend an average of 9.7 million USD per year, while Brazilian local brands spend an average of 7 million USD, which means there is still room for improvement in local football sponsorship.

After obtaining the naming rights for Brazil's top league, Betano led other strategies (previously, they obtained the naming rights for Serie B and the Brazilian Cup in 2023).

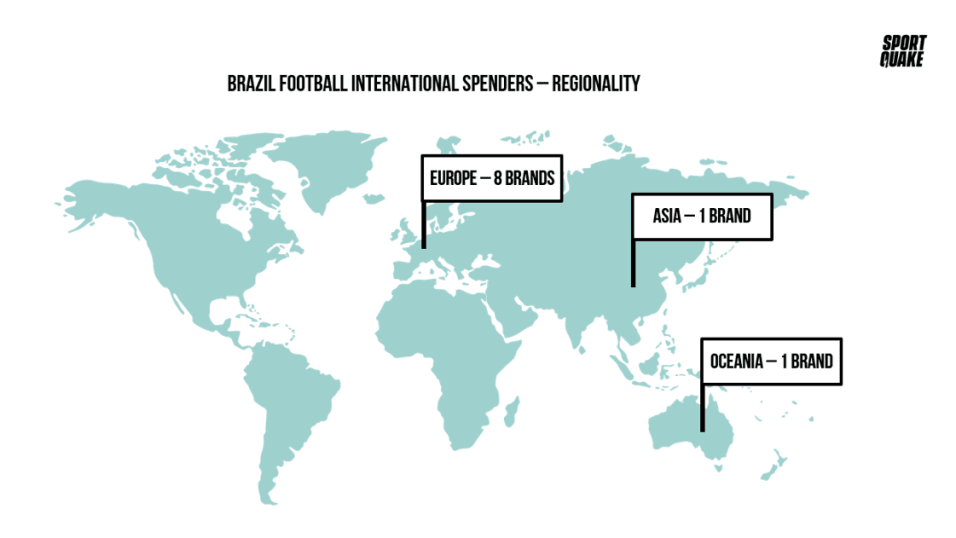

Europe is leading in the international investment race, with eight international investment institutions currently from the region (80%).

Betano is the European football club with the highest spending, adopting a multi-inventory strategy, including the highest quality naming rights cooperation in Brazilian football, as well as front jersey and LED media purchases for Serie A teams.

Romania's Superbet, after obtaining the jerseys of Sao Paulo and the South American Libertadores Cup champion Fluminense team, became the largest international first-time spender so far in 2024, with spending increasing from 0 million USD to an estimated 21 million USD.

From the influx of international operators into the sponsorship market of Brazilian domestic leagues, it is evident that investment in Brazilian sports betting will continue to increase, with new international investments from regions like Asia and North America also further pouring in.

It is clear that the prospects for football sports betting in Brazil are vast.

Opportunities in Other Sports Betting

Although football is synonymous with Brazil, its broad track inevitably squeezes in more competitors.

But this sports-loving country is also known for its success in volleyball, horse racing, basketball, tennis, mixed martial arts, and Formula One racing.

Not just football, a large number of sports are part of people's daily lives and an important part of national identity.

1. Basketball

In the Brazilian Android sports game market, football games are the fastest rising, with basketball and table tennis ranking second in popularity.

The Brazilian national basketball team has also achieved some success on the international stage, having won the FIBA Basketball World Cup twice in 1959 and 1963.

They also won second place in 1954 and 1970 and third place in 1967 and 1978.

The team's success also includes three Olympic bronze medals (1948, 1960, 1964).

Due to Brazilian players (including Leandro Barbosa and Nene) participating in the world's top league NBA, this has also increased the popularity of basketball in Brazil. Basketball games, including national leagues and the NBA, are widely broadcast on Brazilian TV, especially the National Basketball League (NBB) and the NBA.

Brazil has a large fan base. Every year, it attracts a large audience and gambling players. Many people like to bet on NBB games, especially during important playoffs, when the local sports betting market is exceptionally busy.

2. Table Tennis

Brazilian snooker is different from the world, but this does not prevent Brazilians' love for table tennis. Brazilian table tennis has smaller balls and smaller holes than regular snooker.

In 2021, the number of subscribers to the three most popular table tennis YouTube channels in Brazil was as follows: 1.1 million, 611,000 (with nearly 200 million views), compared to the official channel of the World Snooker Tour, which has only 190,000 subscribers.

One of the Brazilian table tennis videos on YouTube has nearly 25 million views and went viral on social media.

These videos are not professional matches, just table tennis players playing for money in a bar environment, from which we can see that gambling through table tennis is a common phenomenon in Brazil.

3. Racing

Brazil is a passionate and sports-loving country, and Brazilians place great importance on F1. Brazil has many racing fans, especially fans of Formula racing and rally racing, and many racing events are held in Brazil every year, attracting numerous spectators and gambling players.

Since the 1950s, Brazil has been hosting a series of racing events, such as the Brazilian Grand Prix and the Sao Paulo Grand Prix, which attract large crowds of spectators.

Racing has deeply integrated into Brazilian sports culture, becoming an indispensable part of people's lives. As racing continues to grow and expand in Brazil, racing gambling has also rapidly emerged.

Many gambling platforms have launched racing gambling projects. On these platforms, players predict various race outcomes such as race results, driver rankings, lap times, etc., based on the driver's strength, the car's performance, and the characteristics of the track, adding more suspense and excitement to the races.

The appeal of racing gambling lies in its simplicity and excitement. Players only need to have a certain understanding of racing to participate and experience the joy and tension brought by racing.

4. Horse Racing

In addition, horse racing gambling is also very popular in Brazil, and racetracks are an important part of the Brazilian gambling industry.

Brazil has the world's fourth-largest horse population. This equestrian culture in Brazil has a long history, dating back over 200 years.

At the same time, Brazil has the world's fourth-largest horse population, with about 5.8 million horses, second only to the USA, Mexico, and China.

Today, the development of equestrian sports and recreational activities has also reshaped horse racing culture. Although there are no official data on Brazilian horse racing, in 2018, the Sao Paulo Jockey Club stated that Brazilian horse racing generates about 1 billion Brazilian reais (245 million USD) in revenue each year. At least 600 million (145 million USD) comes from betting.

The growing popularity of horse racing in Brazil also indicates that this sport will continue to thrive in the future.

Conclusion

When the industry talks about Brazilian gambling, it is basically focused on the track of real money games.

As is well known, Brazilians are very passionate about sports, and they also enjoy cheering for their favorite teams, athletes, and sports through gambling, making the games more exciting and interesting.

In the future, as the sports industry continues to develop and grow, Brazil's sports betting market will also continue to thrive.

In addition to football, the most classic track, other sports such as basketball, table tennis, and racing horse racing also occupy a place in the Brazilian gambling market, which is also worth the attention of industry players.

In short, the Brazilian gambling market shows great potential.

With the Brazilian government's comprehensive legalization reform of the gambling market, the door to the thriving development of the gambling industry has been opened, and the Brazilian gambling market contains huge business opportunities. PASA will continue to work with gambling practitioners to create a more brilliant future for the Brazilian market.

We look forward to discussing more unique insights about Brazilian sports betting with our readers and sincerely invite you to follow the global iGaming leader's overseas information platform PASA for more firsthand industry information.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL