Preface:

Brazil, famous for soccer, has become the fastest growing country in the gambling market in recent years. According to a survey report by Santander Bank, Brazilians spent 150 billion Reais (approximately 26.5 billion USD) on gaming and gambling in 2023.

The survey pointed out that due to the difficulty in collecting data from the illegal gambling market, the estimated expenditure might be understated. Even so, 150 billion Reais represents a significant growth compared to 2018 when Brazilian spending on gambling was estimated at 30 billion Reais (approximately 5.3 billion USD).

From 2018 to 2023, the proportion of gambling expenditure in Brazilian household income rose from 0.8% to 1.9%.

The Brazilian Retail and Consumer Association (SBVC) survey also showed that 63% of respondents stated that part of their income was used for online gambling.

The Brazilian Association of Financial and Capital Markets (ANBIMA) recently released a study on the financial life behavior of adult Brazilians.

The results showed that in 2023, 14% of Brazilians participated in at least one online gambling activity, which encompasses roughly 22 million adults.

The large player base has become the reason for the influx of numerous operators. This article by PASA will share how, in the highly competitive Brazilian market—operators can stand out by understanding Brazilian players' preferences and accordingly devising strategies to create the experience customers seek, ultimately firmly capturing the Brazilian players.

Step One: Attracting Traffic

For operators, the primary task is to attract potential players from Brazil.

According to Google Analytics data:

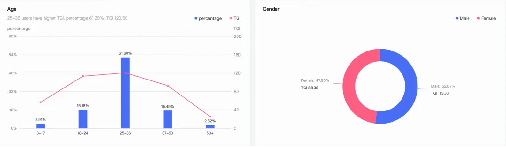

In terms of demographic profiles, the main consumer group for gambling games in Brazil is users aged 25-36 years, accounting for 61%; the overall user age is concentrated between 18-50 years, accounting for 82%; the male and female user ratio is relatively balanced.

By understanding the demographic profile of Brazilian gamblers—who are concentrated among the young and middle-aged population—we know that advertisements on the platform should be made short and directly relate to the product's characteristics and gameplay. Below, PASA lists several key contents.

1. Visual Content

Displaying Gameplay: In the advertisement materials, it's crucial to showcase specific gameplay through fun gameplay steps and highlighting success scenes to attract potential audience interest. It's important to note that if there are multiple types of gameplay, they should be divided into multiple videos, as a single video featuring one gameplay type has a better effect.

Real-life Filming (Targeting Local Population): PASA's research data shows that videos featuring local populations have a higher click-through rate in Brazil. Gambling games featuring real people from the local community can significantly enhance click-through rates. The main methods include amateurs holding smartphones to demonstrate playing the game; multi-person situation short plays, or reviews by KOLs with a fan base, etc.

Highlighting Earnings Elements: Videos can utilize elements like gold coins, cash, etc., to emphasize game earnings. Adding elements related to cash withdrawal success, such as authoritative body logos eligible for cash withdrawal and SMS notifications of income receipt, can add credibility, but be mindful of local regulations and risks.

2. Script and Background Sound Effects

Down-to-earth Voiceover: Using a voiceover to introduce gameplay and earnings, complementing game visuals that cannot fully present the game highlights. It's strongly recommended to use local languages (Portuguese or Spanish) to enhance the video's credibility.

Dynamic Music: Music with a strong rhythm can keep users engaged on the video page. Sound effects that match the content of the video are also essential, such as the sound of coins dropping and cheers of winning which can fully engage people's curiosity.

Step Two: Improving Retention and Loyalty

After attracting traffic, the second step for operators is to improve the retention of Brazilian users and enhance player loyalty by catering to their preferences.

In the Brazilian market, players have a wide variety of preferences regarding game themes and features. Unlike other markets, the most prominent preference is for games that offer more thrilling and layered experiences.

Brazilian players participate in challenges, tournaments, and other competitions more frequently than players from any other market. Therefore, creating effective personalized strategies to deliver the ultimate gaming experience is crucial.

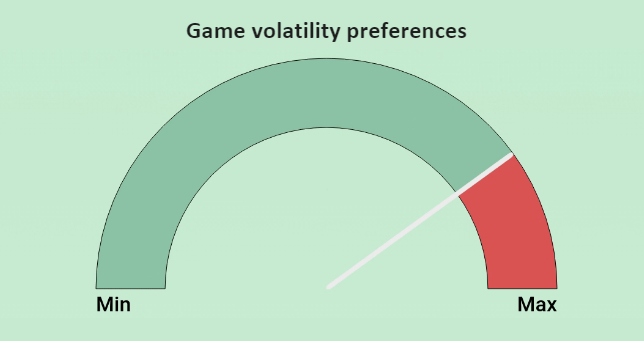

PASA data shows that games with higher volatility are more popular in Brazil, compared to other content, their retention rates are higher, and the betting amounts are also higher; these strategies are apparently more attractive to this group of Brazilian players.

For slot players in Brazil, high to medium volatility content is most popular, ranking in the top 20 games in the country, where the average betting amount is almost eight times higher.

For thrill-seekers, effective bonus strategies must be set up. Based on 15 years of experience in the gambling market, creating entertaining experiences tailored for thrill-seekers doesn't have a single secret to success. Combining interconnected features allows players to feel pleased and engaged.

Therefore, it is essential to continually develop, iterate, and add interactive feature kits, including multi-tiered major prize tools, graded challenges, tournaments, prize wheels, etc.

Operators can create any form of grand prize: adding a major prize to any game and satisfying any player group's needs. Brands can create, configure, and control major prizes for any game and any provider, adding another layer of excitement for thrill-seeking players.

1. Setting Targeted Prize Pools

For example: 1) Operators can choose cumulative prizes to offer players a growing prize pool; over time, players may receive massive prizes.

2) Creating cross-domain grand prizes, which can effectively manage the costs of multi-brand operators. Cross-domain grand prizes allow players from all domains to contribute to the growth of the grand prize, while costs are shared among each brand.

3) Adding time-limited grand prizes to increase excitement for thrill-seekers, this infuses the game experience with a captivating sense of anticipation.

2. Upgrading Challenges Through Betting Tiers

Graded challenges are another way to delight thrill-seekers. There are no limits when creating unlockable rewards for player journeys, but several key elements must be kept in mind:

1) A series of milestone rewards is crucial, primarily in the form of currency (player points) for players to purchase additional benefits, as well as allowing players to take different option paths in the game.

2) Setting multi-level tasks, each level with different rewards; players immediately receive rewards upon reaching a certain level, and users can monitor progress and remaining time.

3. Creating In-game Tournaments/Wheel Rewards

Organizations with regular competitions featuring real-time leaderboards can greatly enhance the excitement of the thrill-seeking group in Brazil.

Real-time leaderboards display all competitors' current scores and game rankings, keeping players engaged and informed.

Based on our experience, prize wheels that mix a variety of free rewards are another good way to attract multiple player categories.

Conclusion

In the rapidly developing Brazilian gambling market, operators need to combine bonuses and gamification tools with data-driven capabilities, real-time marketing, and automation with the help of today's technology. This combination is key to attracting and retaining players for operator success. By implementing innovative strategies, personalized marketing, and the application of cutting-edge technology to provide an excellent user experience, operators can attract new players and enhance the loyalty of existing users.

Of course, it is most important for operators to meet the needs of various types of players; only operators that constantly innovate and improve service quality can stand out in the competitive Brazilian gambling market and achieve sustained growth.

We look forward to exploring more unique insights about the Brazilian gambling market with our readers and cordially invite you to follow the global get-rich industry information platform PASA for more firsthand industry information. Please subscribe to PASA's official channel: https://t.me/pasaqqzxzz