GST Rate Announcement

The adjustment of the GST rate from 18% to 28% was a major policy change aimed at regulating the widespread development of the online gaming industry. This increase was aligned with the government's vision to grow the industry's revenue. This decision took effect in October 2023, with the aim of increasing revenue, but it had varying impacts on the industry. Fiscal data indicates that this increase has had a significant impact. In the most recent financial period, GST revenue from online gaming surged to approximately $822 million, compared to $160 million the previous month.

Government's View on Online Gaming

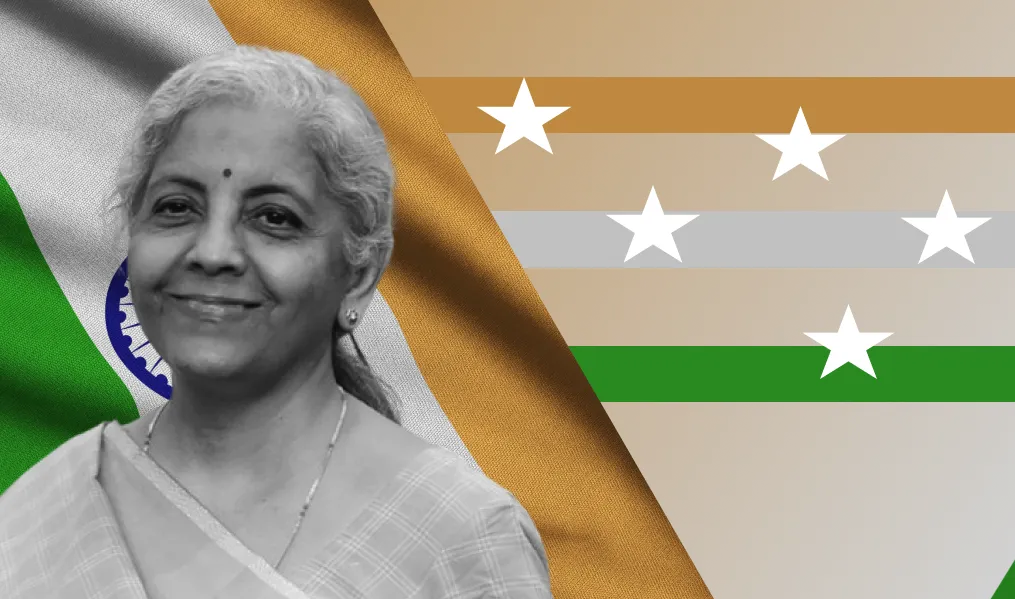

Finance Minister Nirmala Sitharaman emphasized that this revenue growth is proof of the government's effective tax policy. Her focus on the GST increase has played a significant role in boosting government revenue.

Nirmala Sitharaman stated: "The revenue from online gaming has increased by 412%, reaching about $822 million this year." She also added that the revenue from casinos also "increased by 30%."

Furthermore, Indian Prime Minister Narendra Modi also acknowledged India's potential in the gaming industry and expressed hope for future growth and innovation despite the challenges the industry faces.

Narendra Modi mentioned in his Independence Day speech: "I see a huge market emerging in the gaming sector, but even today, the gaming world is heavily influenced by foreign players. India has a rich tradition in this area, and we can bring many new talents to the gaming world."

Despite optimistic revenue data, the online gaming industry still faces challenges in adapting to the higher tax burden. Reports by EY and the US-India Strategic Partnership Forum (USISPF) paint a complex picture of sorrow. While some companies have managed to grow under the new tax burden, a significant portion of the industry faces revenue declines. Surveys show that 42% of companies reported revenue growth between 1-25%, while 58% experienced revenue declines. This transaction also reflects widespread reviews and hiring freezes within the industry.

Potential of the Indian Online Gaming Market

Despite current challenges, India's online gaming industry remains strong. With 442 million players, India is the second-largest gaming market globally, following China. Currently, the industry is valued at $3.1 billion, with an expected growth to $8.92 billion over the next five years. It is anticipated that the online gaming industry will need to adapt to the new tax environment, and companies may explore innovative strategies to manage costs and sustain growth.